43 math worksheets calculating sales tax

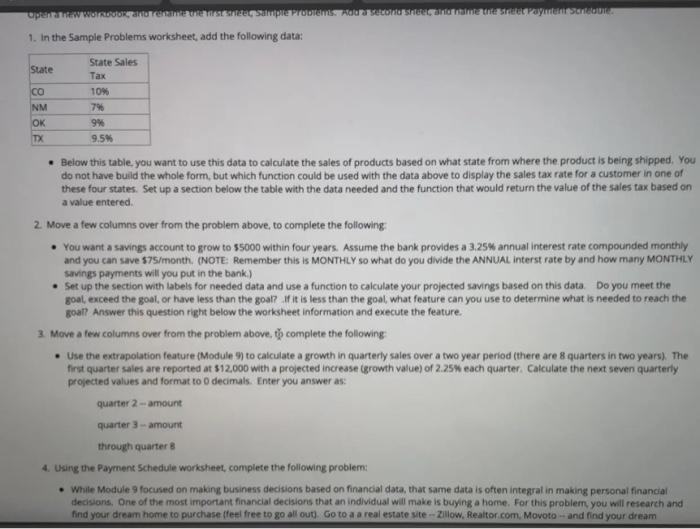

PDF Sales Tax Sheet 1 - Math Worksheets 4 Kids Sheet 1 A) Find the sales tax using the given original price and the sales tax rate. Sales Tax C) S a) S 84 b) c)S 68 S 63 d) S 67 B) Calculate the total cost after including the sales tax. 1)Original price = S 1,250 Sales tax rate = 6% 2)Original price = S 500 Sales tax rate = 2.5% 3)Original price = S 469 Sales tax rate = 5% S75 S23.45 Calculating Sales Tax | Worksheet | Education.com | Money math, Money ... May 31, 2013 - Get a thorough explanation of sales tax, and practice with some fun kids' products. May 31, 2013 - Get a thorough explanation of sales tax, and practice with some fun kids' products. Pinterest. Today. Explore. When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore ...

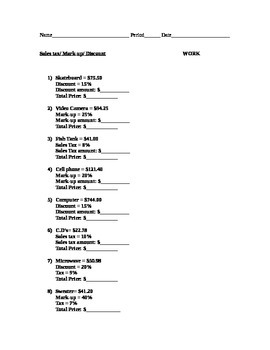

Sales Tax Worksheets Teaching Resources | Teachers Pay Teachers Sales Tax Worksheets by the small but mighty teacher 4.8 (20) $3.00 PDF Activity This product includes 12 worksheets. There are 12 questions on each worksheet, asking students what is the final price with sales tax? With a picture visual of what they are buying as well as the sales tax rate.

Math worksheets calculating sales tax

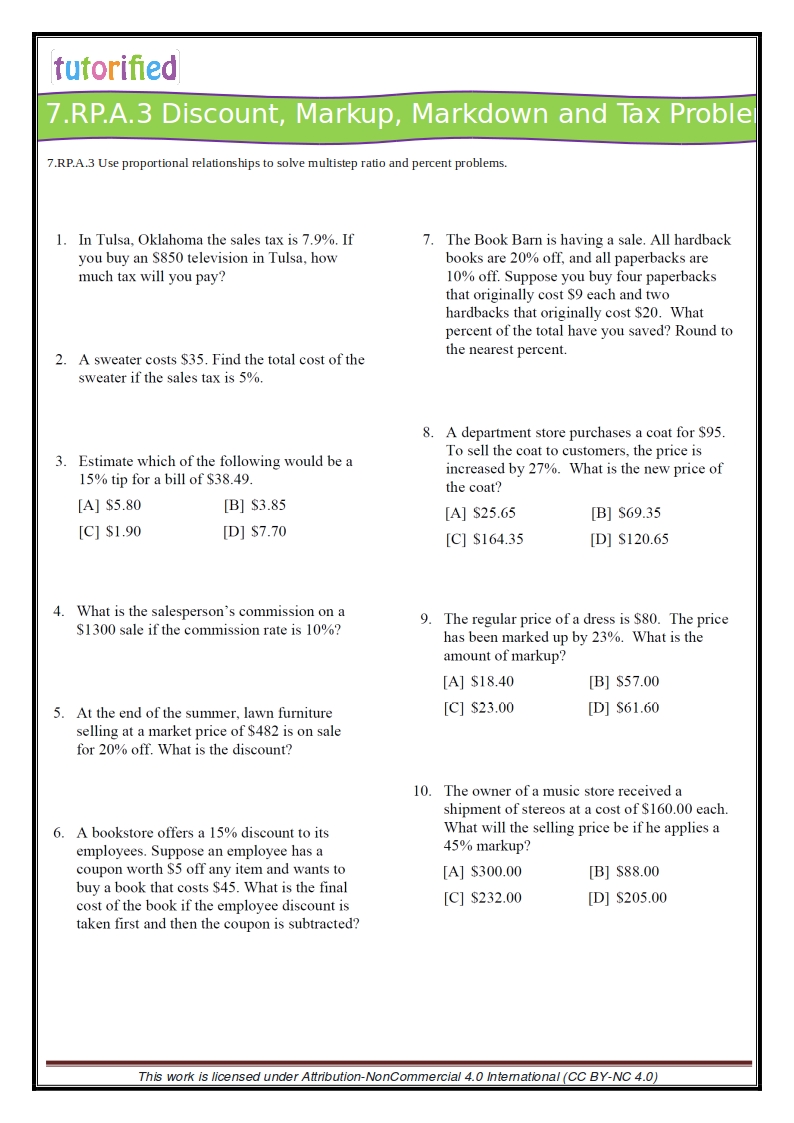

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Fremont, California Sales Tax Calculator (2022) - Investomatica Summary. The average cumulative sales tax rate in Fremont, California is 10.25%. This includes the rates on the state, county, city, and special levels. Fremont is located within Alameda County, California. Within Fremont, there are around 5 zip codes with the most populous zip code being 94536. The sales tax rate does not vary based on zip code. 7th Grade Math Worksheets 7th Grade Math Worksheets ... RP.A.3)- While this seems like meaningless math, there are literally tens-of thousands of people that make their living calculating this value for businesses. Markups and Markdowns Word Problems (7.RP.A.3)- You can test your ability with this at department stores. Why do some stores have nothing, but sales. ...

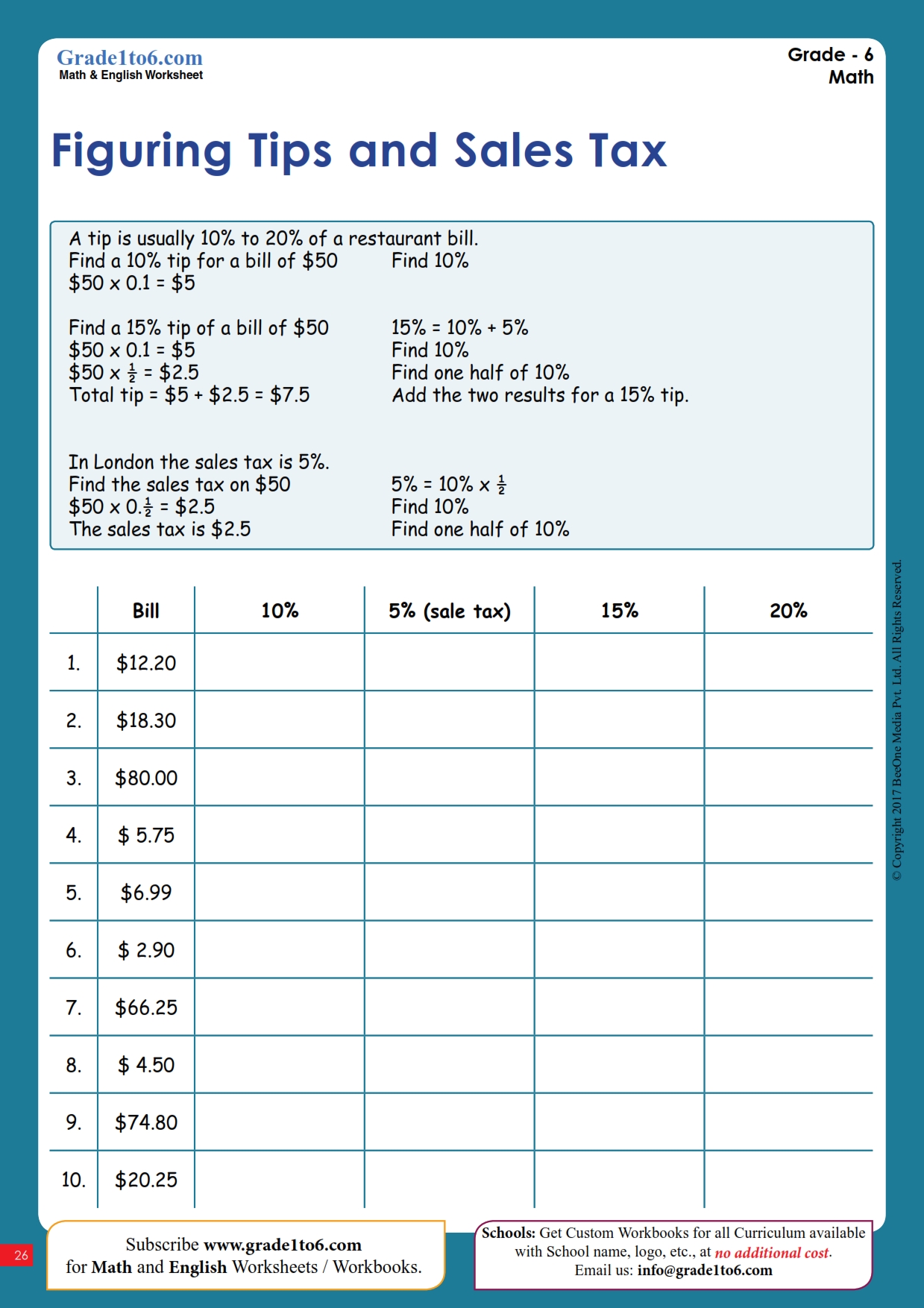

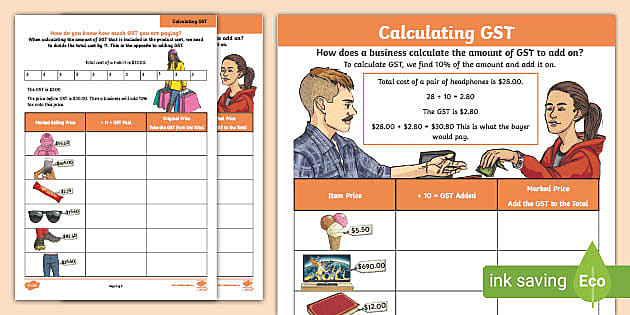

Math worksheets calculating sales tax. Work in Progress: Journal & Report - Study.com Dec 17, 2021 · As a member, you'll also get unlimited access to over 84,000 lessons in math, English, science, history, and more. Plus, get practice tests, quizzes, and personalized coaching to help you succeed. Sales Tax Calculator A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. In most countries, the sales tax is called value-added tax (VAT) or goods and services tax (GST), which is a different form of consumption tax. Browse Printable 5th Grade Math Workbooks | Education.com Browse Printable 5th Grade Math Workbooks. Award winning educational materials designed to help kids succeed. ... Worksheets focus on the core subjects of word study, math, reading and writing. 5th grade. Reading & Writing ... Tap into that interest with practice that includes calculating tips, sales tax and commission. 5th grade. Calculating Sales Tax | Worksheet | Education.com To figure it out, you'll have to practice calculating sales tax. Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems.

› lessons › percentHow To Calculate Discount and Sale Price - Math Goodies Answer: The discount is $3.00 and the sale price is $6.00. Once again, you could calculate the discount and sale price using mental math. Let's look at another way of calculating the sale price of an item. Sales Tax Worksheets - Math Worksheets 4 Kids Use our range of pdf sales tax worksheets to master finding the sales tax amount or original price, solving word problems, filling receipts, and more. ... Teeming with exercises like finding the sales tax, calculating the original price, and solving sales tax word problems, our resources have stupendous practice in store for students in grade 6 ... Calculating a Sales Tax Lesson Plan, Worksheet, Classroom Teaching Activity Students will learn to calculate sales tax. Students will learn to calculate the amount of a sales tax. Students will use that sales tax to calculate a new cost. Lesson - Calculating Sales Tax Lesson ( see below for printable lesson). Many states in the United States have a sales tax. How can we calculate a sales tax? PHSchool.com Retirement–Prentice Hall–Savvas Learning Company PHSchool.com was retired due to Adobe’s decision to stop supporting Flash in 2020. Please contact Savvas Learning Company for product support.

PDF Sales Tax Practice Worksheet - MATH IN DEMAND Sales Tax = $65 x 0.06 Sales Tax = $3.90 Sales Tax = $1.80 If a shirt costs $20 and the sales tax is 9%, how much money do you need to Sales Tax = $20 x 0.09 Total Cost = $20 + $1.80 Total Cost = $21.80 socks that cost $4. If there is an 8% sales tax, how Sales Tax = $4 x 0.08 Sales Tax = $0.32 Total Cost = $4 + $0.32 Total Cost = $4.32 › 77th Grade Math Worksheets What do students learn in Grade 7 math class? Children that are studying in 7th grade are sharp and have the ability to grasp many math operations. Students in 7th grade are taught to solve math problems that touch every sub topic tactfully. The math curriculum covers all math strands and is not limited to just arithmetic. Prove the identity solver - softmath math worksheets add, subtract, multiply, and divide integers ; Prentice Hall Mathematics: Algebra One ... sales +tax printable homework ; ... calculating fractions worksheets ; simplifying calculator ; intermediate algebra online notes ; beginner algebra quiz ; Taxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX. Discount and Sales Tax Lesson Plan. Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1)

softmath.com › math-com-calculator › graphingProve the identity solver - softmath math worksheets add, subtract, multiply, and divide integers ... maths-calculating bearings ... sales +tax printable homework ;

Sales Tax - FREE Math Lessons & Math Worksheets from Math Goodies Answer: The sales tax is $1949.35 and the total cost is $29,990.00 + $1949.35 = $31,939.35. As you can see, for small purchases, sales tax can be a nuisance; whereas for large purchases, sales tax can be a significant amount. Let's look at an example in which the sales tax rate is unknown.

California city and county sales and use tax rates Select search scope, currently: catalog all catalog, articles, website, & more in one search; catalog books, media & more in the Stanford Libraries' collections; articles+ journal articles & other e-resources

› spendingConsumer Math, Spending Money, Worksheets, Lesson Plans ... Practice calculating restaurant check charge totals and taxes. TIPPING LESSON : Restaurant Tipping. Practice calculating a tip at a restaurant. Tipping the waiter or waitress. ESTIMATING YOUR GROCERIES : Estimating Your Groceries. Students practice their math skills at estimation while shopping for groceries. GROCERY SHOPPING WITH COUPONS

Quiz & Worksheet - Calculating Sales Tax | Study.com Calculate the total sale amount of a shirt given the following information: selling price of shirt = $40; sales tax rate = 9%. $3.60 $36.40 $40.00 $43.60 Create your account to access this entire...

California (CA) Sales Tax Rates by City (N) - Sale-tax.com The latest sales tax rates for cities starting with 'N' in California (CA) state. Rates include state, county, and city taxes. 2020 rates included for use while preparing your income tax deduction. ... Sales Tax Calculator | Sales Tax Table. Follow @SaleTaxCom. Sales tax data for California was collected from here. Sale-Tax.com strives to have ...

How To Calculate Discount and Sale Price - Math Goodies Answer: The discount is $3.00 and the sale price is $6.00. Once again, you could calculate the discount and sale price using mental math. Let's look at another way of calculating the sale price of an item.

› indexPHSchool.com Retirement–Prentice Hall–Savvas Learning Company PHSchool.com was retired due to Adobe’s decision to stop supporting Flash in 2020. Please contact Savvas Learning Company for product support.

› taxesTaxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX. Discount and Sales Tax Lesson Plan. Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1)

study.com › academy › lessonWork in Progress: Journal & Report - Study.com Dec 17, 2021 · As a member, you'll also get unlimited access to over 84,000 lessons in math, English, science, history, and more. Plus, get practice tests, quizzes, and personalized coaching to help you succeed.

EOF

Calculating Tax And Tip Worksheets - K12 Workbook Displaying all worksheets related to - Calculating Tax And Tip. Worksheets are Math tip work, Sales tax and discount work, Name period date tax tip and discount word problems, Tip and tax homework work, Name date practice tax tip and commission, Calculating sales tax, Markup discount and tax, Markup discount and tax harder.

Calculate Sales Tax | Worksheet | Education.com Entire Library Worksheets Fourth Grade Math Calculate Sales Tax. Worksheet Calculate Sales Tax. It would be great if we never had to learn about sales tax, but since we do, 4th grade is as good a time as any! Throw in some favorite baseball game snacks for fun and get cracking. Add the sales tax and find how much each person's meal will cost.

Calculating Tax Worksheets - K12 Workbook Worksheets are Sales tax practice work, Work calculating marginal average taxes, Sales tax and discount work, Sales tax and discount work, Income calculation work, Tip and tax homework work, Ira required minimum distribution work, Work for determining support. *Click on Open button to open and print to worksheet. 1. Sales Tax Practice Worksheet 2.

Adding Taxes Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item including taxes

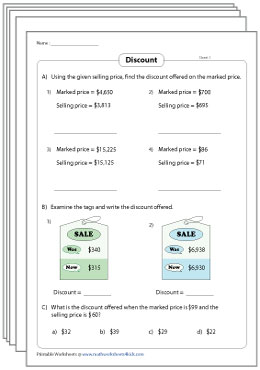

Sales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values.

Consumer Math, Spending Money, Worksheets, Lesson Plans, … Practice calculating receipt totals and taxes while reinforcing basic consumer math skills such as adding and percentages. READING A RESTAURANT MENU : Restaurant Menu Lesson ... Calculate sales tax, using percents to find total cost. BUYING A CAR LOAN INTRODUCTION : Buying a Car - Loan Introduction . Read the car advertisements and answer the ...

math sales tax worksheets - TeachersPayTeachers Sales Tax Worksheets by the small but mighty teacher 4.8 (20) $3.00 PDF Activity This product includes 12 worksheets. There are 12 questions on each worksheet, asking students what is the final price with sales tax? With a picture visual of what they are buying as well as the sales tax rate.

7th Grade Math Worksheets 7th Grade Math Worksheets ... RP.A.3)- While this seems like meaningless math, there are literally tens-of thousands of people that make their living calculating this value for businesses. Markups and Markdowns Word Problems (7.RP.A.3)- You can test your ability with this at department stores. Why do some stores have nothing, but sales. ...

Fremont, California Sales Tax Calculator (2022) - Investomatica Summary. The average cumulative sales tax rate in Fremont, California is 10.25%. This includes the rates on the state, county, city, and special levels. Fremont is located within Alameda County, California. Within Fremont, there are around 5 zip codes with the most populous zip code being 94536. The sales tax rate does not vary based on zip code.

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

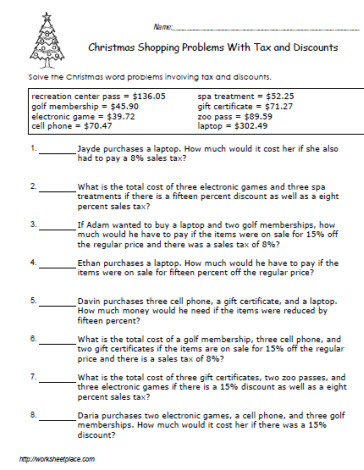

:max_bytes(150000):strip_icc()/Christmas-Shopping-Worksheet-3-56a602eb5f9b58b7d0df784d.jpg)

0 Response to "43 math worksheets calculating sales tax"

Post a Comment